modified business tax id nevada

To avoid duplicate. 3 rows This bill mandates all business entities to file a Commerce Tax return.

Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

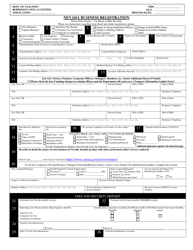

Street Number Direction N S E W and Name Suite Unit or Apt City State and Zip Code 4 State of Incorporation or Formation 7 Nevada Name DBA.

. GovDocFilings easy to complete application form makes the. Click Update once your new information is added. Click on the option to change your username or password and update your contact information.

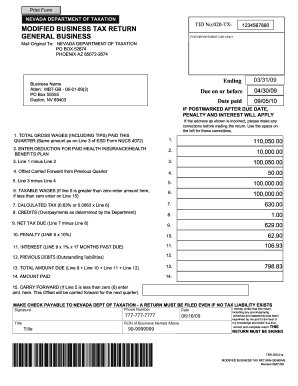

General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans. Messy andor incomplete data is the greatest problem facing most business owners and accountants during this process. Follow the step-by-step instructions below to eSign your nv modified business tax.

Click Here for details. Search by Permit Number TID Search by Address. Locate the New Nevada Employer Welcome Package you received after registering with the DETR.

5 Federal Tax Identification Number 6 CorporateEntity Address. Create your eSignature and click Ok. Search by Business Name.

Or you may mail to. The Department is now accepting credit card payments in Nevada Tax OLT. However the first 50000 of gross wages is not taxable.

The default dates for submission are April 30 July 31 October 31 and January 31. State of Nevada Department of Taxation 2550 Paseo Verde Parkway Suite 180 Henderson NV 89074 Department of Taxation Home Tax Forms Online Services Commerce Tax. This number should be used to address questions regarding sales use tax modified business tax general tax questions or information regarding establishing a new Taxation account.

This number should be used to address questions regarding sales use tax modified business tax general tax questions or information regarding establishing a new account. The Profile option is also listed on every page of your Nevada Tax account. You can easily acquire your Nevada Tax ID online using the NevadaTax website.

However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter. A typed drawn or uploaded signature. If a taxpayer has a delinquent tax return including salesuse tax modified business tax commerce tax or excise tax they should file those returns by mail or at httpstaxnvgovOnLineServicesOnline_Services No refunds will be issued to taxpayers with a delinquent return.

Federal Tax ID EIN Number Obtainment The majority of Nevada businesses will need to get a federal tax ID number. Apply Online Now with NevadaTax Offline Nevada Tax ID Application Form. Qualifying employers are able to apply for an abatement of 50 percent of the tax due during the initial four years of its operations.

If you need help with the Nevada Modified Business Tax Form or the Nevada Modified Business Return AMS Payroll 134 is the best product to try. Please contact us to update one or both of the Nevada account numbers that we have on file for your business. File for Nevada EIN An Easy to Use Business Solution Whether youve formed a corporation created a partnership established a trust or simply opened a new small business you will need a Nevada Tax ID number.

This FAQ pertains to. NV Taxation - Permit Search. Decide on what kind of eSignature to create.

Nevada DETREmployer Account Number. Nevada Modified Business Tax When you register with the Nevada Employment Security Division ESD for Unemployment Compensation for your employees you are automatically registered with the Department of Taxation for Modified Business Tax. Employers who pay employees in Nevada must registerwith the NV Department of Employment Training and Rehabilitation DETR for an Employer Account Number and Modified Business Tax MBT Account Number.

There are three variants. Otherwise no MBT will be due. Follow the on screen instructions to Verify Your Business using the Nevada Tax Access Code found on the Welcome to.

To locate your MBT Account Number. After you log in click the Profile option located in the upper right hand corner of the page. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

File and Pay Online Nevada Tax FAQs How-to videos for Nevada Tax. Our payroll software makes data generation storage and application easy. Additionally the new threshold is decreased from 85000 to 50000 per quarter.

If you have an existing business registered with the Department of Taxation you will need to enter your Business Name and 10-digit Tax ID number. SilverFlume Online Registration Register File and Pay Online with Nevada Tax Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general knowledge of your business. Select the document you want to sign and click Upload.

Modified Business Tax has two classifications. 9 Nevada Business Identification. If you have Taxation-specific questions or comments please contact the Nevada Department of Taxation for assistance at 866 962-3707.

Forms and payments must be mailed to the address below. You will start receiving tax returns from the Department of Taxation. If you have quetions about the online permit application process you can contact the Department of Taxation via the sales tax permit hotline 800 992-0900 or by checking the permit info website.

SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. Click here to schedule an appointment Clark County Tax Rate Increase - Effective January 1 2020 Ask the Advisor Workshops Enter your Nevada Tax Pre-Authorization Code File returns Pay online Review filing payment history How-To Videos. In Nevada there is no state-level corporate income tax.

TID Taxpayer ID Search. 866 962-3707 Carson City Department of Taxation 1550 College Parkway Suite 115 Carson City Nevada 89706 775 684-2000 voice 775 684-2020 fax Reno. SUBMIT A TAX EVASION TIP FORM TO THE DEPARTMENT Download Tax Tip Form PDF E-mail the Tax Tip Formwith any supporting documentation to investigationstaxstatenvus.

Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Business Telephone Fax 8 E-mail Address. Log in online to your DETR account.

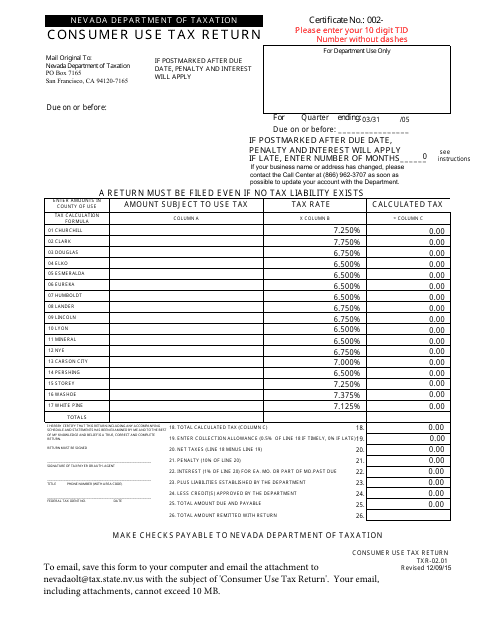

Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165 For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation.

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

State Of Nevada Department Of Taxation Ppt Video Online Download

Nevada Nevada Business Registration Form Download Fillable Pdf Templateroller

Form Txr 02 01 Download Fillable Pdf Or Fill Online Consumer Use Tax Return Nevada Templateroller

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

How To Find A Business License Or Tax Id Nevada Ictsd Org

Incorporate In Nevada Do Business The Right Way

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller