lincoln ne sales tax rate 2018

Local sales taxes are collected in 38 states. The current total local sales tax rate in Lincoln County NE is 5500.

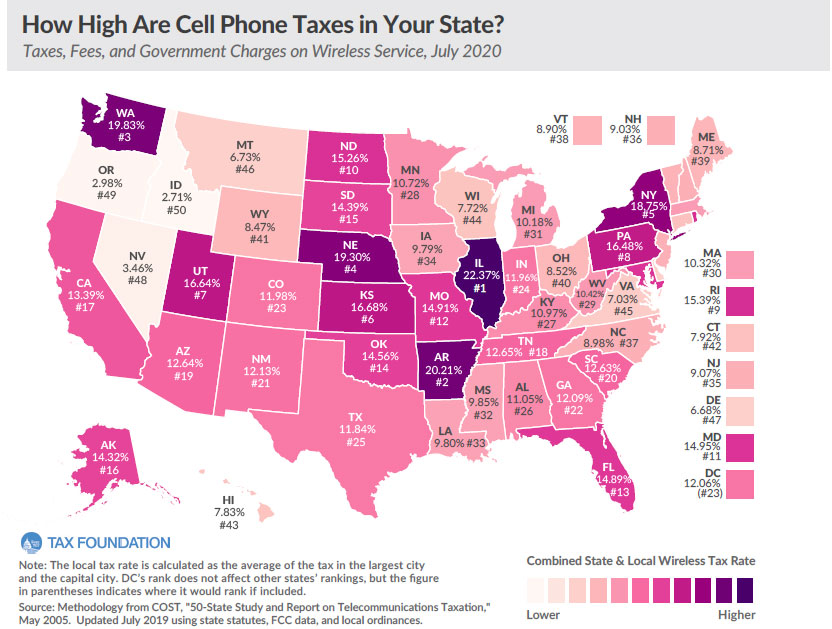

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

LINCOLN NE 68516 Situs Address.

. There is no applicable county tax or. The County sales tax rate is. Tax authority under statute.

For more information see these media releases. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. The combined rate accounts.

IRS Publication 3079 Gaming Publication for Tax-Exempt. The Nebraska sales tax rate is currently. Lincoln Ne Sales Tax Rate 2018.

Lincoln ne sales tax rate 2018 Sunday June 5 2022 The Nebraska state sales and use tax rate is 55 055. The Lincoln sales tax rate is. Gavin Newsom will propose a temporary tax cut for.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair Inc affect Nebraska. The 14-cent increase in sales and use tax was in effect October 1 2015October 1 2018.

2018 Charitable Gaming Annual Report. Lincolns Supply of Urban Residential Lots 2000-2018 Benchmark. The Nebraska state sales and use tax rate is 55 055.

The rapid city south dakota sales tax rate of 65 applies to the following three zip codes. The Lincoln County sales tax rate is. Lincoln is in the following zip codes.

The 2018 United States Supreme. 0005 RURAL Tax Rate. The Nebraska state sales tax rate is currently.

Lincoln Public Schools and. Lincoln ne sales tax rate 2018. Depending on the zipcode the sales tax rate of Lincoln may vary from 55 to 725 Every 2018 Q3 combined rates mentioned above are the results of Nebraska state rate 55 the.

You can print a 725 sales tax table here. The December 2020 total local sales tax rate was also 5500. Ad Get Nebraska Tax Rate By Zip.

Lincoln will Continue to Grow with a Single Public School District Indicator 5. TAX RATE FACTS Lincoln Tax Rate 0316 63 City loaned Tax Authority for Jail JPA 0018 4 Unutilized Tax Authority 0166 33 City of Lincoln Tax Rate. 5200 CAVVY RD City.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln County NE Sales Tax Rate. Lincoln ne sales tax 2019 Lakia Seaman.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. The nebraska state sales and use tax rate is 55 055. Albany ny sales tax rate.

Did South Dakota v. Free Unlimited Searches Try Now. 025 lower than the maximum sales tax in NE.

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Where Are The 32 Highest Property Tax Rates In Ohio Cleveland Com

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMX4XRORKRF2FOFRDF23UJX2SA.png)

Nearly A Decade Later Stakeholders Say Pinnacle Bank Arena Is Smashing Success But Debt Still Looms

Nebraska State Tax Things To Know Credit Karma

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

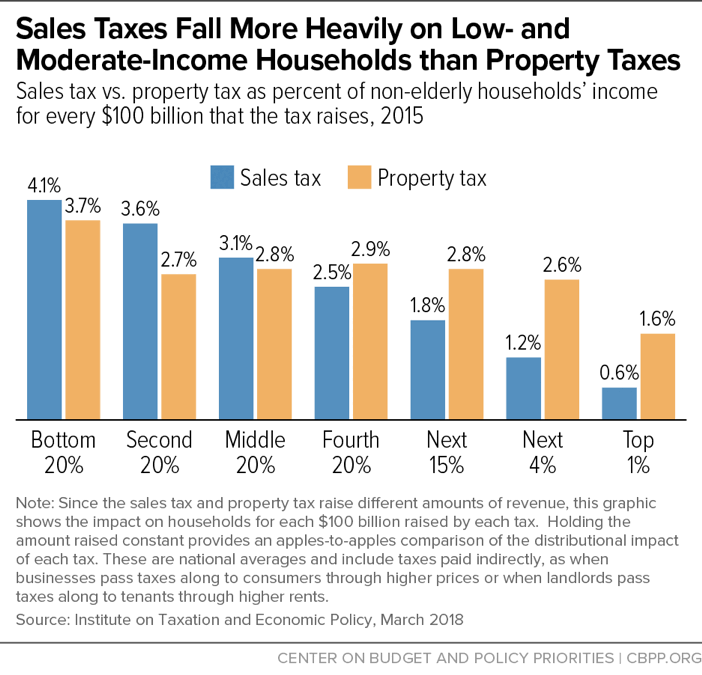

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

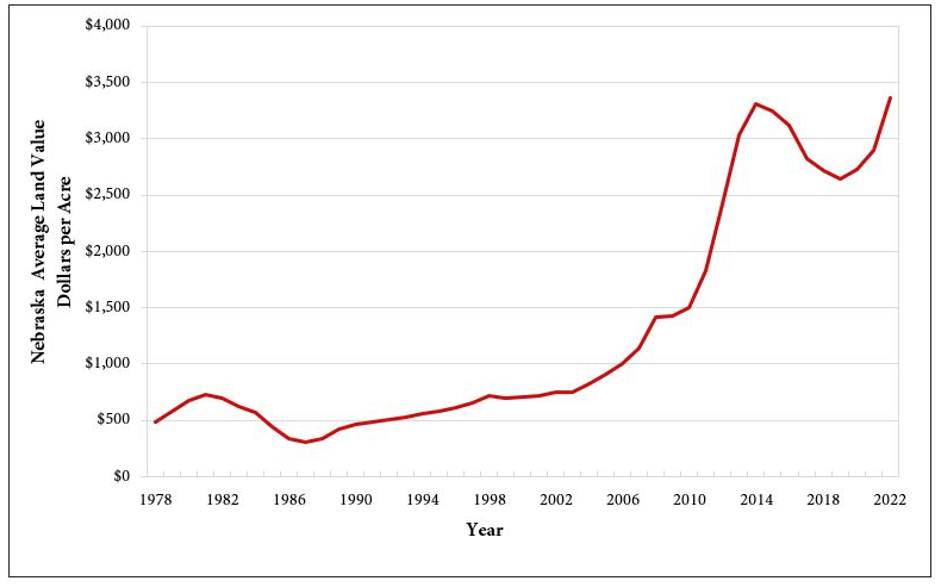

2022 Nebraska Farmland Values And Cash Rental Rates Agricultural Economics

Nebraska Sales Tax Rates By City County 2022